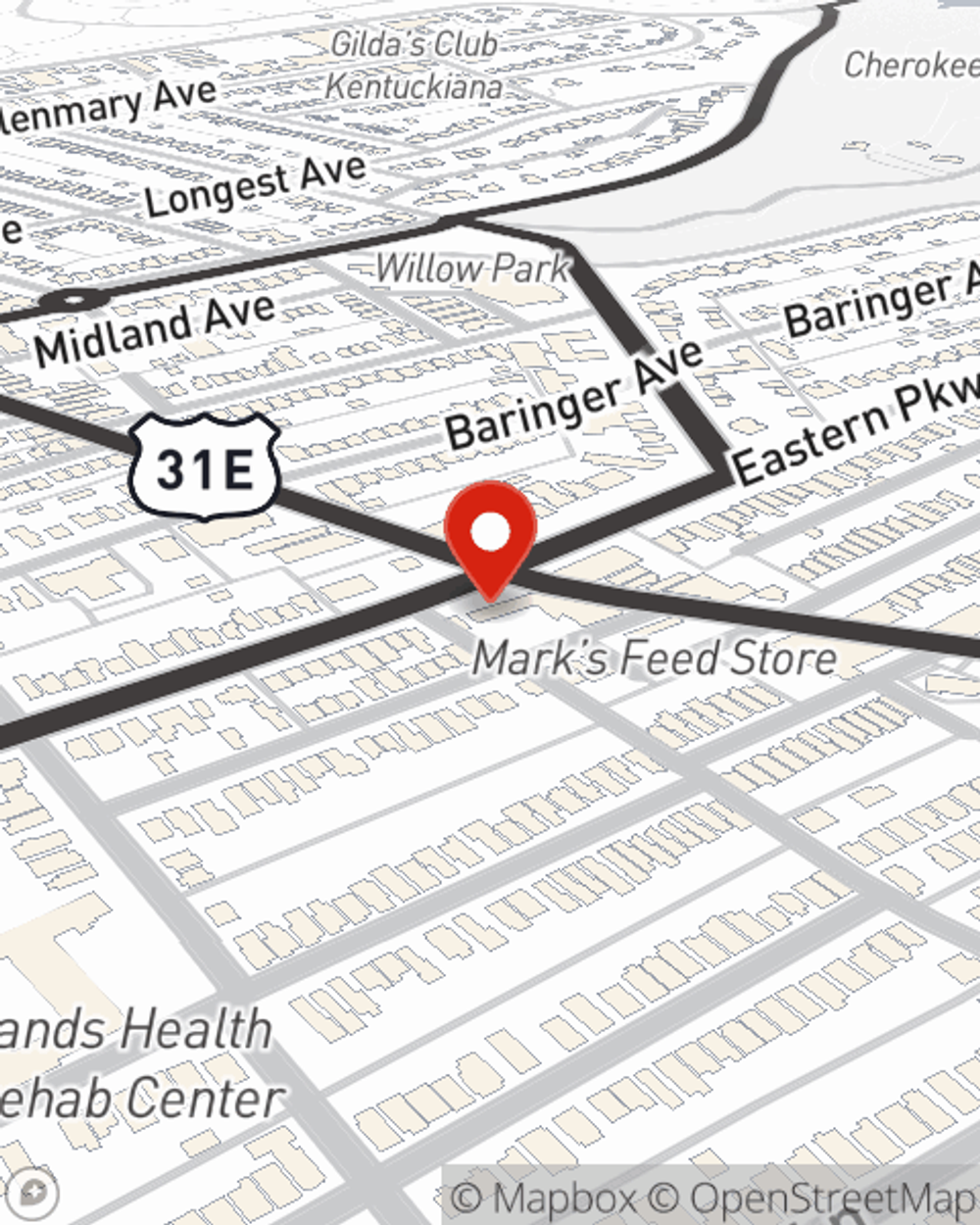

Renters Insurance in and around Louisville

Get renters insurance in Louisville

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Louisville Renters!

There's a lot to think about when it comes to renting a home - price, furnishings, outdoor living space, townhome or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Louisville

Your belongings say p-lease and thank you to renters insurance

Why Renters In Louisville Choose State Farm

When the unanticipated fire happens to your rented space or condo, often it affects your personal belongings, such as a microwave, a cooking set or sports equipment. That's where your renters insurance comes in. State Farm agent Gary Smith wants to help you evaluate your risks so that you can insure your precious valuables.

Call or email State Farm Agent Gary Smith today to discover how a State Farm policy can protect items in your home here in Louisville, KY.

Have More Questions About Renters Insurance?

Call Gary at (502) 450-5930 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.